SCHEDULE 14AUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

(RULE 14a-101)Washington, D.C. 20549

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION

Proxy Statement Pursuant to Section 14(a) OF THE

SECURITIES EXCHANGE ACT OFof

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

THE FIRST BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

| x | No fee required. |

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

The First Bancshares, Inc.

Notice of Special Meeting of Shareholders

to be held on December 29, 2016April 7, 2021

Dear Fellow Shareholder:

We cordially invite you to attend a Specialthe 2021 Annual Meeting (the “Special Meeting”) of Shareholders of The First Bancshares, Inc., the holding company for The First, A National Banking Association, which will be held on Thursday, May 20, 2021 at 4:00 p.m. Central Time. In light of the coronavirus (COVID-19) pandemic and health related concerns, the Company will hold the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) in a virtual-only meeting format, via the internet at www.meetingcenter.io/220649698. The password for this meeting is FBMS2021. At the meeting, we will report on our performance in 2020. We are excited about our achievements in 2020 and our plans for the future and we look forward to discussing these with you. We hope that you can join the meeting.

The attached Notice of Annual Shareholders’ Meeting describes the formal business to be transacted at the Annual Meeting. Members of our Board of Directors and executive officer team will be present at the virtual meeting and available to answer questions regarding the Company.

It is important that your shares be represented at the Annual Meeting whether or not you are able to attend virtually. Even if you plan to attend the meeting virtually, after reading the accompanying proxy materials, the Company encourages you to promptly submit your proxy by Internet, telephone or mail as described in this proxy statement.

The Board of Directors and our employees thank you for your continued support.

| Sincerely, | |

| |

| M. Ray (Hoppy) Cole, Jr. | |

| President and Chief Executive Officer |

The First Bancshares, Inc.

Notice of Annual Meeting of Shareholders

to be held on May 20, 2021

This letter serves as your official notice that The First Bancshares, Inc. (the “Company”), the holding company for The First, A National Banking Association. We hope that you can attend the meeting and look forward to seeing you there.

This letter serves as your official notice that the CompanyAssociation (the “Bank”), will hold the Special Meetingits annual meeting of shareholders on Thursday, December 29, 2016,May 20, 2021, at 4:3000 p.m. atCentral Time in a virtual-only meeting format, via the Company’s main office located at 6480 U.S. Highway 98 West, Hattiesburg, Mississippi 39402. At the Special Meeting, you will be asked to consider and vote oninternet, for the following matters:purposes:

| 1. |

| 2. |

| 3. | To ratify the appointment of BKD, LLP as the Company’s independent registered public accounting firm for fiscal year 2021. |

| 4. | To vote on or transact any other business that may properly come before the meeting or any adjournment of the |

The BoardManagement currently knows of Directors unanimously recommends that you vote in favor of Proposals 1 and 2.

Pursuant to the Company’s bylaws, the onlyno other business permitted to be conductedpresented at the Special Meeting are the matters set forth in this letter and notice of the meeting.

Shareholders owning sharesDue to the public health impact of COVID-19 and our continuing concern for the Company’s common stock athealth and well-being of our employees and shareholders, the meeting will be held in an online-only virtual format. If you were a shareholder of record as of the close of business on November 17, 2016,March 26, 2021, the record date, or hold a legal proxy for the meeting provided by your bank, broker or agent, you are the only persons entitled to attendparticipate in the Annual Meeting by visiting www.meetingcenter.io/220649698 and clicking on “I have a control number”. If you join as a shareholder, you will be able to vote at the meeting. Ayour shares, submit a question and view a complete list of these shareholders and other materials customarily made available at in-person shareholder meetings by following the instructions that will be available on the meeting website. Shareholders may also join as a guest but you will not be able to vote your shares at The First Bancshares, Inc.’s main office prior to and during the meeting.virtual meeting, submit questions, or view otherwise available materials.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS The Board of Directors of the Company unanimously recommends that shareholders vote “FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 29, 2016” the election of four Class II director nominees recommended by the Board of Directors in this proxy statement, “FOR” the approval, on an advisory basis, of the compensation of our named executive officers as described in the proxy statement, and “FOR” the ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the fiscal year 2021.

The Securities and Exchange Commission (the “SEC”) allows issuers to furnish proxy materials to their shareholders over the Internet. You will not receive a printed copy of the proxy materials, unless specifically requested. The Notice of Internet Availability of Proxy Statement forMaterials will instruct you as to how you may access and review all of the special meeting is available atwww.edocumentview.com/FBMS

Please use this opportunity to take partimportant information contained in the affairsproxy materials. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your company by votingproxy on the business to come before this meeting. Even if you planInternet. You are cordially invited to attend the annual meeting virtually. However, to ensure that your vote is counted at the Company encourages you to complete and return the enclosedannual meeting, please vote your proxy to us as promptly as possible.

| By Order of the Board of Directors, | ||

|  | |

| M. Ray | E. Ricky Gibson | |

| President and | Chairman of the Board | |

| Executive Officer | ||

Dated and Mailed on or about November 29, 2016, April 7, 2021

Hattiesburg, Mississippi

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 20, 2021

Proxy materials for the Annual Meeting of Shareholders of The First Bancshares, Inc., which include this Notice, the proxy statement, the proxy card and the Annual Report to Shareholders for the year ended December 31, 2020, are available at www.edocumentview.com/FBMS. If you would like to receive a printed or emailed copy of the proxy materials, please follow the instructions set forth in the notice that was mailed to you.

3

The First Bancshares, Inc.

6480 U.S. Highway 98 West

Hattiesburg, Mississippi 39402

Proxy Statement for the SpecialAnnual Meeting of

Shareholders to be Held on December 29, 2016May 20, 2021

INTRODUCTION

Date, Time, and Place of Meeting

A SpecialThe Annual Meeting of Shareholders (the"Special Meeting" “Meeting”) of The First Bancshares, Inc. (the"Company" “Company”),a Mississippi corporation and the holding company for The First, A National Banking Association (the “Bank”) will be held atin a virtual-only meeting format, via the main office of the Company located at 6480 U.S. Highway 98 West, Hattiesburg, Mississippi 39402,internet, on Thursday, December 29, 2016,May 20, 2021 at 4:3000 p.m., local time, Central Time, or any adjournment(s) thereof, for the purpose of considering and voting upon the matters set out in the foregoing Notice of SpecialAnnual Meeting of Shareholders. Due to the public health impact of COVID-19 and our continuing concern for the health and well-being of our employees and shareholders, the meeting will be held in an online-only virtual format. This Proxy Statementproxy statement is furnished to the shareholders of the Company in connection with the solicitation by the Board of Directors of proxies to be voted at the Meeting. This proxy statement summarizes the information that you need to know in order to cast your vote at the Meeting. You do not need to attend the virtual Meeting to vote your shares of our common stock.

Attending the Virtual Meeting as a Shareholder of Record

If you were a shareholder of record at the close of business on March 26, 2021, you are eligible to attend the virtual meeting by accessing www.meetingcenter.io/220649698 and entering the control number found on the Proxy Card or Notice of Internet Availability of Proxy Materials and the meeting password, FBMS2021.

Registering to Attend the Virtual Meeting as a Beneficial Owner

If you were a beneficial owner of record (i.e., you hold your shares through a broker, bank or other agent) at the close of business on March 26, 2021, and you wish to attend the virtual Annual Meeting, you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy, please email or scan an image of it to our transfer agent, Computershare Shareowner Services LLC, at legalproxy@computershare.com, with “Legal Proxy” noted in the subject line. Please note that the voting instruction form or Notice Regarding Availability of Proxy Materials you received with the Company’s proxy statement is not a legal proxy. If you do request a legal proxy from your broker, bank or other agent, the issuance of the legal proxy will invalidate any prior voting instructions you have given and will prevent you from giving any further voting instructions to your broker, bank or agent to vote on your behalf. You will only be able to vote at the Annual Meeting.

Requests for registration of shareholders who are beneficial owners of record must be received by Computershare no later than 4:00 p.m. Central Daylight Time, on May 17, 2021. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the meeting, go towww.meetingcenter.io/220649698 and enter your control number and the meeting password, FBMS2021.

Asking Questions

Shareholders are invited to submit questions for consideration for the Annual Meeting by members of the Board of Directors and management. To facilitate the process, the Company asks shareholders to submit their questions on or before 4:00 p.m. Central Daylight Time on May 18, 2021 by accessing the virtual meeting website available atwww.meetingcenter.io/220649698, password FBMS2021. Shareholders who participate in the meeting (by entering a control number and password as detailed above) may also submit questions regarding proposals during the meeting up until the time the relevant proposal is presented. Questions should relate to the official business of the meeting, and management and shareholders in particular.

In accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”), we are permitted to furnish proxy materials, including this proxy statement and our 2020 annual report, to shareholders by providing access to these documents online instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless requested. Instead, most shareholders will only receive a notice that provides instructions on how to access and review our proxy materials online. If you would like to receive a printed or emailed copy of our proxy materials free of charge, please follow the instructions set forth in the notice that was mailed to you to request the materials. This proxy statement is available to you online at www.edocumentview.com/FBMS. If you receive more than one notice, it means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please either vote each account over the Internet or by telephone or sign and return by mail all proxy cards.

The mailing address of the principal executive office of the Company is Post Office Box 15549, Hattiesburg, Mississippi, 39404-5549.

The approximate date on which this Proxy Statementproxy statement and form of proxy are first being sentmailed or givenmade available to shareholders is November 29, 2016.April 7, 2021

The mattersRecord Date; Voting Rights; Quorum; Matters to be considered and voted uponBe Considered at the Special Meeting will be:Meeting; Vote Required

1.Conversion of Convertible Preferred Stock. To approve, for purposes of NASDAQ Listing Rule 5635, the issuance of 3,563,380 shares of common stock upon the conversion of an equivalent number of Mandatorily Convertible Non-Cumulative Non-Voting Perpetual Preferred Stock, Series E, as contemplated by the Securities Purchase Agreements described below.

2.Adjournment of Special Meeting if Necessary or Appropriate. To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies from shareholders who have not submitted proxies at the time of the initially convened Special Meeting if there are insufficient votes at the time of the Special Meeting to adopt Proposal 1.

Record Date; Quorum; Voting Rights; Vote Required

The record date for determining holders of outstanding common stock of the Company entitled to notice of and to attend and vote at the Special Meeting is November 17, 2016March 26, 2021 (the "Record Date"“Record Date”). Only holders of the Company'sour common stock of record on the books of the Company at the close of business on the Record Date are entitled to notice of and to attend and vote at the Special Meeting or at any adjournment or postponement thereof. As of the Record Date, there were 5,428,01721,018,319 shares of the Company'sour common stock issued and outstanding, each of which is entitled to one vote on all matters. In order for the Special Meeting to be duly convened, a quorum must be present,each matter presented. Shareholders do not have cumulative voting rights.

Under Mississippi law and a quorum requires thatour Amended and Restated Bylaws, as amended (the “Bylaws”), the holders of a majority of the shares ofour common stock beissued and outstanding and entitled to vote, present in person or represented by proxy, will constitute a quorum at the meeting ApprovalMeeting. In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of Proposals 1the Meeting, the Meeting may be adjourned or postponed to permit the further solicitation of proxies. The inspector of election will determine whether a quorum is present at the Meeting. If you are a beneficial owner (as defined below) of shares of our common stock and 2 requiresyou do not instruct your bank, broker, trustee or other nominee how to vote your shares on any of the affirmative vote ofproposals, and your bank, broker, trustee or nominee submits a majority of votes castproxy with respect to your shares on a matter with respect to which discretionary voting is permitted, your shares will be counted as present at a duly convened meeting. Abstentions and broker non-votes are counted onlythe Meeting for purposes of determining whether a quorum exists. In addition, shareholders of record who are present at the Meeting virtually or by proxy will be counted as present at the Meeting for purposes of determining whether a quorum exists, whether or not such holder abstains from voting on any or all of the proposals. Also, a “withhold” vote with respect to the election of a director nominee will be counted for purposes of determining whether there is presenta quorum at the Meeting, but will not be considered to have been voted for the director nominee.

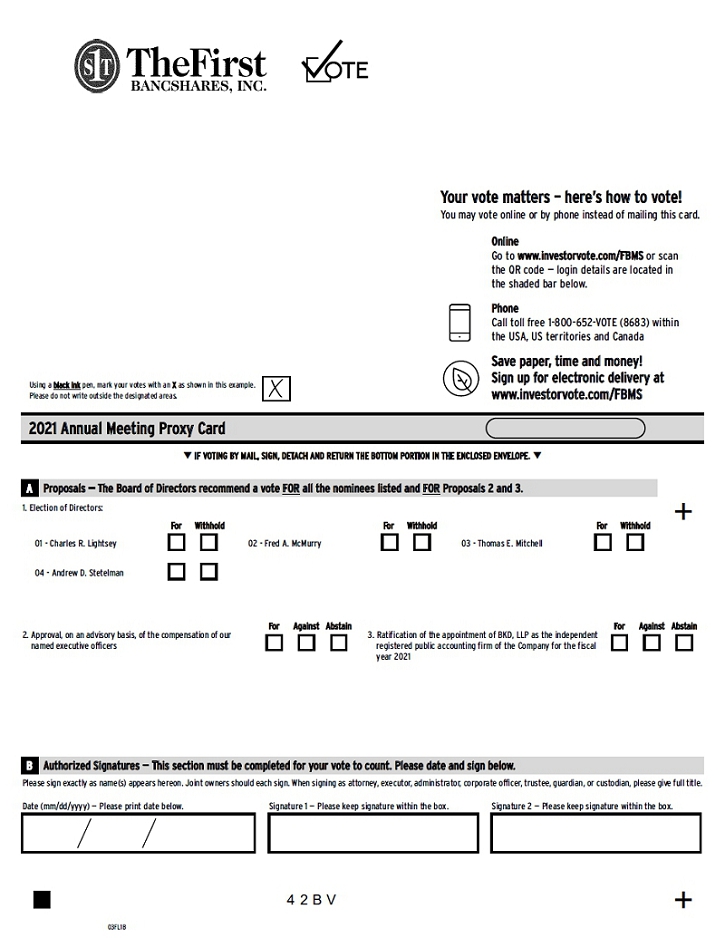

At the Meeting, you will be asked to (1) elect four Class II director nominees; (2) approve, on an advisory basis, the compensation of our named executive officers; (3) ratify the appointment of BKD, LLP as the Company’s independent registered public accounting firm for fiscal year 2021; and (4) consider any other matter that properly comes before the Meeting. As of the date of this proxy statement, management currently knows of no other business to be presented at the meeting.

The Board of Directors recommends that you vote:

| · | FOR the election of four Class II director nominees recommended by the Board of Directors in this proxy statement; |

| · | FOR the approval, on an advisory basis, of the compensation of our named executive officers as described in the proxy statement; and |

| · | FOR the ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the fiscal year 2021. |

By signing, dating and returning a proxy card or submitting your proxy and voting instructions via the Internet or telephone, you will give to the persons named as proxies discretionary voting authority with respect to any matter that may properly come before the Meeting, and they intend to vote on any such other matter in accordance with their best judgment. We do not expect any matters to be presented for action at the Meeting other than the matters described in this proxy statement. However, if any other matter does properly come before the Meeting, the proxy holders will vote any shares of our common stock, for which they hold a proxy to vote at the Meeting, in their discretion.

Proposal | Voting Options | Vote Required to Adopt the | Effect of | Effect of Broker | ||||

No. 1: Election of four Class II director nominees | For or withhold on each director nominee | Plurality of votes cast | N/A | No effect | ||||

| No. 2: Approval, on an advisory basis, of the compensation of our named executive officers | For, against or abstain | Votes cast in favor exceed votes cast against | No effect | No effect | ||||

| No. 3: Ratification of the appointment of BKD, LLP as the independent registered public accounting firm of the Company for the fiscal year 2021 | For, against or abstain | Votes cast in favor exceed votes cast against | No effect | N/A |

Our directors are elected by a plurality of the votes cast. This means that the candidates receiving the highest number of “FOR” votes will be elected. Under our Bylaws, to decide any other matters that come before the Meeting, the votes cast in favor of the matter must exceed the votes cast against the matter, unless a different vote is required by law, our Amended and Restated Articles of Incorporation, as amended, or our Bylaws.

Submitting Proxies and Voting Instructions

If your shares of our common stock are registered directly in your name with our transfer agent, Computershare Shareowner Services LLC, you are the shareholder of record of those shares and you will receive proxy materials from the transfer agent. You may submit your proxy and voting instructions via the Internet, telephone or by mail as further described below. Your proxy, whether submitted via the Internet, telephone or by mail, is the person designated on the proxy card to act as your proxy at the Meeting to represent and vote your shares of our common stock as you directed, if applicable.

Holders of record may vote their shares as follows:

| · | Submit Your Proxy and Voting Instructions via the Internet or over the telephone |

| § | You may submit your proxy and voting instructions via the Internet or telephone until 10:59 p.m. Central Time on May 19, 2021. |

| § | Please have your proxy card available and follow the instructions on the proxy card. |

| · | Submit Your Proxy and Voting Instructions by Mail |

| § | Complete, date and sign your proxy card and return it in the postage-paid envelope provided. |

| § | If you are signing in a representative capacity (for example as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and your title or capacity. |

| § | Your proxy card must be received prior to May 20, 2021 in order for your shares to be voted. |

If you submit your proxy and voting instructions via the Internet or telephone, you do not need to mail your proxy card. The proxies will vote your shares of our common stock at the Meeting as instructed by the latest dated proxy received from you, whether submitted via the Internet, telephone or by mail. You may also vote in person virtually at the Meeting.

In addition, Mississippi law does not provide dissenters’If your shares of our common stock are held by a bank, broker, trustee or appraisal rightsother nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker, trustee or other nominee that is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee or other nominee on how to vote your shares of our stockholders in connection with eithercommon stock via the Internet or by telephone, if the bank, broker, trustee or other nominee offers these options or by completing, signing, dating and returning a voting instruction form. Your bank, broker, trustee or other nominee will send you instructions on how to submit your voting instructions for your shares of the proposals.

Proxiesour common stock.

Shares of common stock represented by properly executed proxies, unless previously revoked, will be voted at the Special Meeting in accordance with the directions therein. If a properly executed proxy is submitted but no direction isvoting instruction are specified, such shares will be voted as the Board of Directors recommends, namely FOR each director nominee listed in this proxy statement, FOR the approval, on an advisory basis, of the compensation of our named executive officers, and FOR the ratification of the appointment of the independent registered public accounting firm, and in the discretion of the person named asin the proxy holder with respect to any other business that may come before the Special Meeting.

Unless a new record date is fixed, your proxy will still be valid and may be used to vote shares of our common stock at the postponed or adjourned Meeting.

A proxy may be revoked by a shareholder at any time prior to itsthe exercise thereof by filing with the Secretary of the Company a written revocation or a duly executed proxy bearing a later date.date at Post Office Box 15549, Hattiesburg, Mississippi, 39404 Attn: Corporate Secretary. A proxy shallmay also be revoked if the shareholder is presentattends the virtual Meeting and elects to vote in person virtually. Your attendance alone at the Meeting will not be enough to revoke your proxy.

Broker-Non-Votes

Rules of the New York Stock Exchange (“NYSE”) generally govern voting of shares by banks, brokers, trustees and other nominees who hold shares for beneficial owners. In making those determinations, the NYSE rules provide that the broker must first determine whether proposals presented at shareholder meetings are “discretionary” or “non-discretionary.” If you are a beneficial owner and a proposal is determined to be discretionary, then your bank, broker, trustee or other nominee is permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. If you are a beneficial owner and a proposal is determined to be non-discretionary, then your bank, broker, trustee or other nominee is not permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. A “broker non-vote” occurs when a bank, broker, trustee or other nominee holding shares for a beneficial owner returns a valid proxy, but does not vote on a particular proposal because it does not have discretionary authority to vote on the matter and has not received voting instructions from the shareholder for whom it is holding shares.

Under the NYSE rules, the proposal relating to the ratification of the appointment of the independent registered public accounting firm of the Company is a discretionary proposal. If you are a beneficial owner and you do not provide voting instructions to your bank, broker, trustee or other nominee holding shares for you, your bank, broker, trustee or other nominee may vote your shares with respect to the ratification of the appointment of the independent registered public accounting firm.

Under the rules of the NYSE, the proposals relating to the election of directors and the compensation of our named executive officers are non-discretionary proposals. Accordingly, if you are a beneficial owner and you do not provide voting instructions to your bank, broker, trustee or other nominee holding shares for you, your shares will not be voted with respect to these proposals. Without your voting instructions, a broker non-vote will occur with respect to your shares on each non-discretionary proposal for which you have not provided voting instructions.

Householding

We are permitted to send a single Notice of Annual Shareholders’ Meeting (“Notice”) and any other proxy materials we choose to mail to shareholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. If you would like to receive a separate copy of a proxy statement or annual report, either now or in the future, or if you would like to request householding and are currently receiving multiple copies, please contact us in writing at the following address: Post Office Box 15549, Hattiesburg, Mississippi, 39404 Attn: Corporate Secretary. In addition, if you would like to receive a separate copy of a proxy statement in the future, you may also contact us at 601-268-8998. If you hold your shares through a bank, broker or trustee or other nominee and would like to receive additional copies of the Notice and any other proxy materials, or if multiple copies of the Notice or other proxy materials are being delivered to your address and you would like to request householding, please contact your nominee.

Voting Results

The Company will publish the voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days following the Annual Meeting.

Other Matters

Shareholders who have questions about the matters to be voted on at the Annual Meeting or how to submit a proxy should contact Chandra B. Kidd, Secretary, The First Bancshares, Inc., P.O. Box 15549, Hattiesburg, Mississippi, 39404 or by phone at (604) 268-8998 or by e-mail at ckidd@thefirstbank.com.

8

PROPOSAL 1 – Election of Directors

Current Membership on the Board of Directors

The Board of Directors is divided into three classes with staggered terms, so that the terms of only approximately one-third of the Board members expire at each annual meeting. The current terms of the Class II directors will expire at the Meeting. The term of each of the Class III directors will expire at the 2022 annual meeting of shareholders and the term of the Class I directors will expire at the 2023 annual meeting of shareholders. Our current directors and their classes as of March 26, 2021 are as follows:

Class I | Class II | Class III | ||

| Rodney D. Bennett, Ed.D (I) | Charles R. Lightsey (I) | David W. Bomboy, M.D. (I) | ||

| Renee Moore (I) | Fred A. McMurry (I) | M. Ray (Hoppy) Cole, Jr. | ||

| Ted E. Parker (I) | Thomas E. Mitchell (I) | E. Ricky Gibson (I) | ||

| J. Douglas Seidenburg (I) | Andrew D. Stetelman (I) |

| (I) | Indicates independent director under NASDAQ director independence standards. |

There are no arrangements or understandings between any of the directors and any other person pursuant to which he or she was selected as a director. No current director has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers. During the previous 10 years, no director, person nominated to become a director, or executive officer of the Company was the subject of any legal proceeding that is material to an evaluation of the ability or integrity of any such person.

Class II Director Nominees

At the Meeting, shareholders are being asked to elect Charles R. Lightsey, Fred A. McMurry, Thomas E. Mitchell and Andrew D. Stetelman as Class II director nominees each to serve a three-year term, expiring at the 2024 annual meeting of shareholders, or until their successors are duly elected and qualified. They all currently serve as Class II Directors. Information regarding the director nominees is provided below under “Information About Director Nominees.”

The person named as proxy on the proxy card intends to vote your shares of our common stock for the election of the four Class II director nominees, unless otherwise directed. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement. If, contrary to our present expectations, any director nominee is unable to serve or for good cause will not serve, your proxy will be voted for a substitute nominee designated by the Board of Directors, unless otherwise directed.

Vote Required to Elect Director Nominees

Under our Bylaws, our directors are elected by a plurality of votes cast by the shares entitled to vote and present at the Meeting.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE four CLASS II director nomineeS, MESSRS. Lightsey, McMurry, Mitchell and Stetelman.

Information about Director Nominees and Continuing Directors

The following provides relevant information regarding each director’s particular experience, qualifications, attributes, or skills that, when considered in the aggregate, led the Board of Directors to conclude that the person should serve as a director of the Company:

Information about Director Nominees

Class II Director Nominees

Charles R. Lightsey, 81, has been a director of the Company since 2003 and is also a director of the Bank.

Background: Mr. Lightsey has owned his own business, Charles R. Lightsey, Social Security Disability Representative, since January 2000. Mr. Lightsey worked with the Social Security Administration from 1961 to 2000, serving as District Manager of the Laurel Office from 1968 to 2000. He is a recipient of The Commissioner's Citation, the highest accolade accorded by the Social Security Administration. His community involvement includes serving as a former deacon of the First Baptist Church of Laurel, member and Board of Directors of the Laurel Kiwanis Club, president of the Laurel-Jones County Council on Aging, member of the Pine Belt Mental Health Association Council and Chairman of the Federal, State and Local Government United Way. He received his degree in Management and Real Estate from the University of Southern Mississippi in 1961. Mr. Lightsey served as director of the First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Lightsey has served on the Company’s board since 2003. His background as a manager with the Social Security Administration and his business ownership experience provide the Board with a broad range of knowledge and business acumen. His business experience has equipped him with the skills necessary to be a leader on the Board and to serve as chairman of the corporate governance committee.

Fred A. McMurry, 56, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. McMurry is currently President and General Manager of Havard Pest Control, Inc. a family-owned business where he has served for over 33 years. He also serves on the board of the Bureau of Plant Industry of the Mississippi Department of Agriculture and Commerce and the Dixie National Junior Livestock Sales Committee. In addition, he is President of West Oaks, LLC and Vice President of Oak Grove Land Company, Inc.

Experience/Qualifications/Skills: Mr. McMurry has been a director of the Company since its inception in 1995. He contributes his extensive knowledge of the Lamar County area of Mississippi, which is one of the Company’s primary markets. His many years of experience of small business experience give him a broad understanding of the needs of the Company’s customers as well as insight into the economic trends in the area. He also has been involved in real estate development [through his participation in West Oaks, LLC and Oak Grove Land Company, Inc.], which adds value to loan discussions.

Thomas E. Mitchell, 73, has been a director of the Company since 2017 and is also a director of the Bank.

Background: Mr. Mitchell joined the Board of Directors of the Bank in July 2016. He serves as President of Stuart Contracting Co., Inc. a major area contractor known for large-scale school, government, industrial and commercial projects of all types located in Bay Minette, AL, a position he has held since 1975. Mr. Mitchell is involved in numerous other partnerships and companies and is a part owner in a number of shopping center projects and office parks and various other residential and commercial projects in Alabama. He is a member of First Baptist Church of Bay Minette, where he serves as a deacon.

Experience/Qualifications/Skills: Mr. Mitchell served on the Board of Directors of SouthTrust Corporation from 1996 until 2004 and has served as director for American Fidelity Insurance Company since 2014. Mr. Mitchell’s vast business experience as well as his knowledge of the Alabama and Florida markets is an asset to the Board. Mr. Mitchell’s experience provides the Board with valuable insight into the trends and risks of the market in which he lives and works.

Andrew D. Stetelman, 60, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Stetelman has served as a realtor with London and Stetelman Realtors since 1981. He graduated from the University of Southern Mississippi in 1983. He has served in many capacities with the National, State, and Hattiesburg Board of Realtors, including serving as President from 1987 to date. He was selected as Realtor of the Year in 1992 of the Hattiesburg Board of Realtors and in 2001 he became the first Mississippi Commercial Realtor of the Year. He has served as the chairman of the Hattiesburg Convention Center since 1994, serves as a board member of the Area Development Partnership, and is a member of the Kiwanis International.

Experience/Qualifications/Skills: Mr. Stetelman has been a director of the Company since its inception in 1995. His experience in commercial real estate and real estate investments provides the Board with insight into the trends and risks associated with residential, rental, and commercial real estate within all of the Company’s markets. His broad insight and knowledge related to real estate is very valuable to the Board and its oversight of the Company’s loan portfolio.

Information about Continuing Directors

Rodney D. Bennett, Ed.D, 54, has been a director of the Company since 2017 and is also a director of the Bank.

Background: Since 2013, Dr. Bennett has served as the President of The University of Southern Mississippi in Hattiesburg, Mississippi. In this role, he is responsible for the management and administrative oversight of every facet of institutional operations on two campuses. He is affiliated with the American College Personnel Association, the New President’s Academy Advisory Committee, American Association of State Colleges and Universities, the NCAA/Conference USA, as well as numerous other organizations.

Experience/Qualifications/Skills: Dr. Bennett’s background and numerous affiliations provide the Board with a broad range of experience and knowledge of organizational management. His insight provides significant value to the Board.

David W. Bomboy, M.D., 75, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Dr. Bomboy is a lifelong resident of Hattiesburg, Mississippi. He received a B.S. with honors in Pre-Medicine from the University of Mississippi in 1968 and earned an M.D. degree from the University of Mississippi Medical Center in 1971. Dr. Bomboy completed his orthopedic surgical training at the University of Mississippi in 1976. He is a board-certified orthopedic surgeon and has practiced orthopedics in southern Mississippi for 41 years. Dr. Bomboy is a member of the Mississippi State Medical Association, the American Medical Association, and the Mississippi Orthopedic Society. He also served as president of the Methodist Hospital Medical Staff.

Experience/Qualifications/Skills: Dr. Bomboy is the sole physician on the Company’s board which enables him to bring a different perspective to the challenges the board faces. His background, experience, and knowledge of the medical and business communities are important in the board’s oversight of management. His past involvement in real estate development adds additional insight to board oversight and review of the Bank’s loan portfolio.

11

PROPOSAL 1M. Ray (Hoppy) Cole, Jr., 59, served as director of the Company from 1998 to 1999 and from 2001 through the present and is also a director of the Bank.

Background: Mr. Cole has served as President and CEO of the Company and the Bank since 2009 and has served as the Vice Chairman of the Company’s Board of Directors since 2010. Prior to joining the Bank in September 2002, Mr. Cole was Secretary/Treasurer and Chief Financial Officer of the Headrick Companies, Inc. for eleven years. Mr. Cole began his career with The First National Bank of Commerce in New Orleans, Louisiana and held the position of Corporate Banking Officer from 1985-1988. In December of 1988, Mr. Cole joined Sunburst Bank in Laurel, Mississippi serving as Senior Lender and later as President of the Laurel office. Mr. Cole graduated from the University of Mississippi where he earned a Bachelor's and Master's Degree in Business Administration. Mr. Cole attended the Stonier Graduate School of Banking at the University of Delaware. Mr. Cole also served as director of the First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Cole has served on the board of the Company for more than fifteen years and has extensive knowledge of all aspects of the Company’s business. His many years of experience in banking and his leadership in building our Company make him well qualified to serve as a director. His insight is an essential part of formulating the Company’s policies, plans and strategies.

E. Ricky Gibson, 64, serves as Chairman of the Board and has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Gibson has been president and owner of N&H Electronics, Inc., a wholesale electronics distributor, since 1988 and of Mid South Electronics, a wholesale consumer electronics distributor, since 1993. He attended the University of Southern Mississippi. He is a member of Parkway Heights United Methodist Church.

Experience/Qualifications/Skills: Mr. Gibson has served on the board of the Company since its inception in 1995. As a business owner and distributor, Mr. Gibson is knowledgeable about all aspects of running a successful business and he understands the challenges business owners face. Also, he has developed an understanding of the Company’s bank and the banking industry in general, particularly in the area of audit and executive compensation. He serves as Chairman of the Board of both the Company and the Bank and has served as chairman of the audit committee of the Bank’s Board of Directors and is chairman of the compensation committee of the Company’s Board of Directors.

Renee Moore, 59, Hattiesburg, MS, has been a director of the Company since 2020 and is also a director of the Bank.

Background: Ms. Moore, CPA and partner in charge of tax services at Topp McWhorter Harvey, PLLC, is a resident of Hattiesburg, MS and has more than 30 years of public and private accounting experience. She is active in the community, serving on the Forrest General Foundation Planned Giving Committee, the 2019 Heart Walk Executive Leadership Team, and as an Ambassador for the Area Development Partnership of Greater Hattiesburg. She also served as team captain for the Leadership Division of the Area Development Partnership Forward Together Capital Campaign. Ms. Moore earned her Bachelor of Science degree in Accounting from the University of Arkansas at Little Rock.

Experience/Qualifications/Skills: Throughout Ms. Moore’s career, she has held numerous leadership positions. From CFO of a privately-held company to partner in charge of a major service division in the sixth largest firm in the state, her experience in both public accounting and industry, as well as experience gained when she and her husband owned and operated their own business, have given her a unique understanding and perspective. She also has experience as Audit Manager for a national bank. Her experience and skills are a valuable resource to the Board.

Ted E. Parker, 61, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Parker has been in the stocker-grazer cattle business for more than 30 years as the owner and operator of Ted Parker Farms LLC. He attended the University of Southern Mississippi and served as a licensed commodity floor broker at the Chicago Mercantile Exchange from 1982 to 1983. He served on Bayer Animal Health Advisory Board from 2010 to 2016 and on the Marketing and International Trade Committee of the National Cattleman’s Beef Association from 2015 to 2017. He served as a board member of Farm Bureau Insurance from 1992 to 1994. He is a member of the National Cattlemen's Association, the Texas Cattle Feeders Association, Covington County Cattlemen’s Association, and Seminary Baptist Church.

Experience/Qualifications/Skills: Mr. Parker has served on the board of the Company since its inception in 1995. His experience in the cattle business provides the Board with insight into the needs of the agricultural community in the Company’s markets. His insight into the market in which he lives through his community involvement are important assets to the Board.

J. Douglas Seidenburg, 61, has been a director of the Company since 1998 and is also a director of the Bank.

Background: Mr. Seidenburg has served as the owner and President of Molloy-Seidenburg & Co., P.A., an accounting firm, since 1989. He has been a CPA since 1983. Mr. Seidenburg is involved in many civic, educational, and religious activities in the Jones County area. Past activities include serving as president of the Laurel Sertoma Club, president of the University of Southern Mississippi Alumni Association of Jones County, treasurer of St. John's Day School, director of Leadership Jones County and a member of Future Leaders of Jones County. He was also one of the founders of First Call for Help, a local United Way Agency started in 1990. Mr. Seidenburg is a 1981 graduate of the University of Southern Mississippi, where he earned a B.S. degree in Accounting. Mr. Seidenburg also served as director of the the First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Seidenburg has served on the Board of the Company since 1998. He is Chairman of the Audit Committee and has been designated as a financial expert. His experience as a CPA and his knowledge of corporate governance provide the Board with an understanding of the financial and accounting issues that are faced by companies in today’s business environment.

PROPOSAL 2 – Advisory Vote on the Compensation of our Named Executive Officers

Pursuant to Section 14A of the Exchange Act, we provide our shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement in accordance with the rules of the SEC (the “say-on-pay proposal”). This vote does not address any specific item of compensation but rather the overall compensation of our named executive officers and our compensation philosophy and practices as disclosed in the section titled “Executive Officer Compensation.” This disclosure includes the “Compensation Discussion and Analysis” and the “Executive Compensation Tables” set forth below, including the accompanying narrative disclosures. At the 2020 annual meeting of shareholders, we provided our shareholders with the opportunity to cast a non-binding advisory vote regarding the compensation of our named executive officers as disclosed in our proxy statement for the 2020 annual meeting of shareholders. Our say-on-pay proposal was approved by approximately 74% of our shareholders whose shares were present in person or by proxy at the 2020 annual meeting and who voted or affirmatively abstained from voting (excluding broker non-votes). We are again asking our shareholders to vote on the following resolution:

RESOLVED, that the shareholders of The First Bancshares Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the proxy statement for the Company’s 2021 Annual Meeting of Shareholders pursuant to Item 402 of Regulation S-K of the rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the narrative executive compensation disclosures to the compensation tables included in this proxy statement.

We understand that executive compensation is an important matter for our shareholders. Our core executive compensation philosophy and objectives continue to be designed to reward the achievement of specific annual, long-term and strategic goals by the Company, and which aligns the interests of the executive officers with the Company’s overall business strategy, values and management initiatives intended to reward executives for strategic management and the enhancement of shareholder value and support a performance-oriented environment that rewards achievement of internal goals. In considering how to vote on this proposal, we encourage you to review all the relevant information in this proxy statement, including the “Compensation Discussion and Analysis”, the “Executive Compensation Tables,” and the rest of the narrative disclosures regarding our executive compensation program in the section titled “Executive Officer Compensation”.

While this advisory vote is not binding, the Board of Directors and the Compensation Committee value the opinion of our shareholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

Vote Required to Approve, on an Advisory Basis, the Compensation of Our Named Executive Officers:

Proposal No. 2 will be approved if votes cast in favor of the proposal exceed votes cast against it.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE ISSUANCECOMPENSATION OF SHARES OF COMMON STOCK UPON THE CONVERSION OF THE COMPANY’S SERIES E NONVOTING CONVERTIBLE PREFERRED STOCK INTO COMMON STOCKOUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

EXECUTIVE OFFICER COMPENSATION

Our named executive officers (“NEOs”) for 2020 and the positions held by them on December 31, 2020 are:

M. Ray (Hoppy) Cole, Jr., 59, CEO and President of the Company and the Bank, Vice Chair of the Company’s Board of Directors. Mr. Cole’s biography is provided above under “Information about Continuing Directors.”

Donna T. (Dee Dee) Lowery, CPA, 54, Executive Vice President and Chief Financial Officer of the Company and the Bank. Ms. Lowery has served as Executive Vice President and Chief Financial Officer of the Company and the Bank since she joined the Company in February 2005. Prior to joining the Company, Ms. Lowery was Vice President and Investment Portfolio Manager of Hancock Holding Company from 2001 to 2005. Ms. Lowery began her career in 1988 with McArthur, Thames, Slay and Dews, PLLC as a staff accountant. In June 1993, she joined Lamar Capital Corporation, and held several positions beginning with Internal Auditor from 1993 to 1995, Comptroller from 1995 to 1998 and then Chief Financial Officer and Treasurer from 1998 to 2001, until the merger in 2001 with Hancock Holding Company. Ms. Lowery graduated from the University of Southern Mississippi where she earned a Bachelor’s Degree in Business Administration with an emphasis in Accounting. Ms. Lowery serves on the Advisory Board for the Business School at the University of Southern Mississippi.

14

Compensation Discussion and Analysis

Overview of Compensation Program

The Compensation Committee (for purposes of this analysis, the “Committee”) of the Board of Directors has responsibility for establishing, implementing and monitoring adherence with the Company’s compensation philosophy. The Committee ensures that the total compensation paid to the named executive officers is fair, reasonable and competitive. Generally, the types of compensation and benefits provided to the named executive officers are similar to those provided to other executive officers in publicly traded financial institutions.

2020 Financial Highlights

| · | Net income of $52.5 million, increasing 20% from 2019; | |

| · | Net interest income of $152.7 million compared to $121.8 million in 2019, an increase of 20%; and | |

| · | On April 2, 2020, the Company closed its acquisition of SWG, parent company of Southwest Georgia Bank, headquartered in Moultrie, GA. The acquisition added 8 full service offices servicing the areas of Moultrie, Valdosta, Albany and Tifton, Georgia. Systems integration was completed during the second quarter of 2020. | |

| · | In year-over-year comparison, net income available to common shareholders increased $8.8 million, or 20.0%, from $43.7 million for the year ended December 31, 2019 to $52.5 million for the year ended December 31, 2020. |

| · | Excluding the bargain purchase and the sale of land gain of $8.3 million, net of tax, and the increased provision expense of $16.5 million, net of tax, net income available to common shareholders increased $17.0 million in year-over-year comparison. |

| · | Provision for loan losses totaled $25.2 million for the year ended December 31, 2020 as compared to $3.7 million for the year ended December 31, 2019, an increase of $21.4 million or 572.8%, primarily resulting from the economic effects of the COVID-19 pandemic. |

| · | On September 25, 2020, the Company announced the completion of a private placement of $65.0 million of its 4.25% fixed to floating rate subordinated notes due 2030 to certain qualified institutional buyers. |

| · | As of December 31, 2020, total COVID related modifications were $82.0 million, representing 2.6% of the loan portfolio and down from a peak of $672 million or 21% of the loan portfolio. |

| · | During the first quarter of 2020, the Company elected to delay the adoption of CECL afforded through the CARES Act. The Company currently anticipates CECL adoption to occur as of January 1, 2021. |

Compensation Philosophy and Objectives

The Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific short-term, long-term and strategic goals by the Company, and which aligns the interests of the executive officers with the Company’s overall business strategy, values and management initiatives. The Company’s compensation policies are intended to reward executives for strategic management and the enhancement of shareholder value and support a performance-oriented environment that rewards achievement of internal goals. The Company has also adopted a Compensation Philosophy that provides guidance to the Committee when making decisions surrounding the compensation of the NEOs. . Incentive compensation (cash and/or equity) will target cash and direct compensation at the 50th percentile when target performance is achieved and between the 60th and 75th percentiles when annual/long-term goals are exceeded. The philosophy has a strong emphasis on incentive compensation programs that provide an alignment between pay and performance.

The Committee evaluates both performance and compensation to ensure that the Company maintains its ability to attract and retain superior employees in key positions and that compensation provided to key employees remains competitive relative to the compensation paid to similarly situated executives of peer companies.

Our executive compensation programs are designed to align the interests of our NEOs with those of our shareholders. Based on our performance, findings from the 2019 Executive Compensation Review (discussed later in the CD&A), and our commitment to linking pay and performance, the Committee made the following executive compensation decisions for fiscal year 2020. For more detail, please refer to the “2020 Executive Compensation Components” later in the CD&A:

| · | Base Salaries: Base salaries were increased approximately 5% for each NEO, effective December 2019 . |

| · | 2020 Short-Term Incentives/Cash Bonuses: Based on our 2020 financial performance and the NEOs’ individual performance, the NEOs earned their maximum short-term incentives equal to 30% to 60% of base salary. The maximum opportunity was set at 60% (for the CEO) and 30% (for the CFO) of base salary. |

| · | 2020 Long-Term Incentives: The NEOs were eligible to receive up to 6,500 shares (CEO) and 3,300 shares (CFO) based on performance. The NEOs earned the maximum number of shares. In addition, both NEOs were granted a special restricted stock grant for the successful completion and integration of the acquisition of First Florida Bank and Southwest Georgia Bank. |

Summary of Executive Compensation Practices

Our executive compensation program includes the following practices and policies, which we believe promote sound compensation governance and are in the best interests of our shareholders:

| What We Do | |

| · | Periodically, compare our NEO compensation levels to the market and take these results into consideration when making compensation related decisions. |

| · | Provide our NEOs with a performance-based cash incentive plan on an annual basis. |

| · | Grant full-value equity to each of our NEOs with multi-year vesting provisions. |

| · | Provide each of our NEOs with supplemental executive retirement plans to encourage retention and promote stability in our executive group. |

| · | Utilize the assistance of an outside independent compensation consultant to assist our Compensation Committee with gathering market data and best practices information. |

16

Role of Executive Officers in Compensation Decisions

The Committee annually reviews, determines and recommends to the Board for approval the annual compensation, including salary, incentives (cash and/or equity) and other compensation of the Chief Executive Officer, including corporate goals and objectives relevant to compensation of the Chief Executive Officer, and evaluates performance in light of these goals and objectives.

The Committee and the Chief Executive Officer annually review the performance of each of the named executive officers (other than the Chief Executive Officer whose performance is reviewed by the Committee). The CEO recommends salary adjustments and annual award amounts based on these reviews, other than for himself, to the Committee. The Committee can exercise discretion in modifying or adjusting recommended compensation or awards to executives. The Committee then submits its recommendations on executive compensation to the full Board for approval.

Setting Executive Compensation

The Compensation Committee monitors the results of our annual advisory vote on executive compensation each year. Our advisory say-on-pay proposal at the 2020 annual meeting of shareholders received an affirmative vote of approximately 74% in favor of our 2019 executive compensation. As a result, the Compensation Committee did not implement any specific changes to our executive compensation programs based on the 2020 shareholder advisory vote. The Compensation Committee monitors the results of each year’s say-on-pay proposal vote and considers such results as one of many factors in connection with the discharge of its responsibilities. The Company maintains active engagement with our shareholders, communicating directly with the holders of our outstanding common stock each year regarding the Company’s performance and responding to any questions or issues they may raise. We encourage shareholders to communicate with us regarding our corporate governance and executive compensation. Communications from shareholders on these subjects are reported to the Compensation Committee or the Corporate Governance Committee, as appropriate.

Based on the foregoing objectives, the Committee has structured the Company’s annual and long-term incentive-based cash and non-cash executive compensation to motivate executives to achieve the business goals set by the Company and reward the executives for achieving such goals.

Independent Compensation Consultant

The Committee has retained Blanchard Consulting Group (“Blanchard”), an independent third party compensation consultant, to provide research for benchmarking purposes related to executive compensation. Blanchard is a national consulting firm with an exclusive focus on the banking and financial services industry. Blanchard does not provide any services to the Company besides compensation consulting services, and reports directly to the Compensation Committee. The Compensation Committee has evaluated Blanchard’s independence, including the factors relating to independence specified in Nasdaq Stock Market Listing Rules, and determined that Blanchard is independent and that their work with the Committee has not raised any conflict of interest.

Additionally, the Company participates in and utilizes the Mississippi Bankers Association (“MBA”) survey, which provides the Committee with comparative salary data from the Company’s market areas.. The Blanchard and MBA data is used by the Committee to ensure that it is providing competitive compensation comparable to its peer group, thereby allowing the Company to retain talented executive officers who contribute to the Company’s overall long-term success.

In 2019, the Committee utilized Blanchard assessed executive officer base salary and total compensation as compared to a peer group of sixteen publicly traded banks. The peer companies included the following:

| 1 | Seacoast Banking Corporation of Florida | SBCF |

| 2 | First Bancorp | FBNC |

| 3 | Republic Bancorp, Inc. | RBCA.A |

| 4 | FB Financial Corporation | FBK |

| 5 | Origin Bancorp, Inc. | OBNK |

| 6 | Franklin Financial Network, Inc. | FSB |

| 7 | Community Trust Bancorp, Inc. | CTBI |

| 8 | Carolina Financial Corporation | CARO |

| 9 | Live Oak Bancshares, Inc. | LOB |

| 10 | HomeTrust Bancshares, Inc. | HTBI |

| 11 | Stock Yards Bancorp, Inc. | SYBT |

| 12 | Capital City Bank Group, Inc. | CCBG |

| 13 | Atlantic Capital Bancshares, Inc. | ACBI |

| 14 | SmartFinancial, Inc. | SMBK |

| 15 | Home Bancorp, Inc. | HBCP |

| 16 | Business First Bancshares, Inc. | BFST |

For the 2019 review of executive compensation against benchmarking data, the Committee reviewed the following summary by Blanchard:

| · | Total Cash Compensation = Base Salary + Annual Cash Incentives / Bonus; | |

| · | Direct Compensation = Total Cash Compensation + Three-Year Average Equity Awards; and | |

| · | Total Compensation = Direct Compensation + Other Compensation + Retirement Benefits / Perquisites |

Blanchard’s 2019 assessment of FBMS’ compensation practices and levels concluded that:

| · | FBMS’ financial performance was comparable versus peers; comparisons to the peer group/market 50th percentile were appropriate | |

| · | “Total Cash Compensation” of the NEOs was relatively conservative when compared to peer at a level that was below the peer group 25th percentile in 2019; | |

| · | For “Direct Compensation,” FBMS had provided competitive equity awards but the below market salaries and cash incentives positioned direct compensation at or below the peer group 25th percentile; and | |

| · | “Total Compensation” showed that FBMS had conservative executive benefits as total compensation for the NEOs remained below the peer group 25th percentile (this was prior to the implementation of the Mr. Cole’s 2020 SERP and Ms. Lowery’s 2021 SERP). |

The Compensation Committee used Blanchard’s reports and analysis to assist with decisions regarding NEO compensation during 2020 but did not solely rely on such reports and analysis. The ultimate decisions made by the Committee were a balance between the Committee’s compensation philosophy and strategy along with the outside perspective of its independent consultant.

BackgroundFBMS Compensation Peer Group change from 2018 to 2019

The compensation peer group for The First Bancshares, Inc. (FBMS) changed from the 2018 to the 2019 study because of the Bank’s increase in asset size and Reasonsacquisitions in the previous peer group. In 2018 we used an asset size range from $1.5B to $6B in the states of Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, and Tennessee. Because of FBMS’s asset growth in 2019 to over $3.4B in assets when the study was conducted, we increase the asset size range in the compensation peer group for Requesting Shareholder Approval2019 to $2B to $7B, which is within ISS and Glass Lewis standards. We used the same states as the 2018 study which resulted in a peer group of 16 publicly traded banks (listed above).

18

Compensation Policies and Practices as They Relate to Risk Management

The Company’s compensation plans incorporate a balance of profitability and strategic goals, such as core deposit growth, asset quality, and audit/compliance ratings, to ensure the officers of the Company are focusing both on profits and strategic goals that are linked to the long-term viability of the organization.

The Compensation Committee has reviewed with the Bank’s Chief Risk Officer the employee incentive compensation arrangements and has determined that such arrangements do not encourage employees to take unnecessary and excessive risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee has adopted the following market practices and policies to reduce risk:

| · | We align NEO compensation with stockholder interests; |

| · | We tie the majority of NEO pay to objective, challenging financial goals and Company performance; |

| · | We avoid excessive risk while designing incentive programs; |

| · | We maintain stock ownership guidelines for all NEOs; |

| · | We do NOT provide for excise tax gross-up for “excess parachute payments” under Section 280G of the Internal Revenue Code of 1986, as amended (“Code”) in any new management agreements; |

| · | We maintain a clawback policy applicable to all NEOs; |

| · | We utilize an independent consultant to help the Committee understand compensation practices that impact NEO compensation; and |

| · | We provide for minimum required vesting periods for our equity awards. |

2020 Executive Compensation Components

Historically, and for the fiscal year ended December 31, 2020, the principal components of compensation for named executive officers consisted of the following:

| · | base salary; |

| · | performance-based cash incentive compensation; |

| · | equity incentive compensation based on achievement of performance targets; |

| · | retirement and other benefits; and |

| · | perquisites and other personal benefits. |

Base Salary

The Company provides named executive officers and other employees with base salary to compensate them for services rendered during the fiscal year.

During its review of base salaries for executives, the Committee primarily considers: 1) performance of the Company; 2) market data as discussed above; 3) the level of the executive’s compensation, both individually and relative to other officers; and 4) individual performance of the executive. Salary levels are typically considered annually as part of the Company’s performance review process as well as upon a promotion or other change in job responsibility. When reviewing whether to award salary increases, the Committee determines a base salary range and targets the median of the range (50th percentile) for executives that are meeting performance expectations and the upper quartile of the range (75th percentile) for executives that are high performers or exceeding performance expectations. Base salary ranges for named executive officers are determined for each executive based on the Company’s peer group and the competitive market using market research and based on his or her position and responsibility. Merit based-increases to salaries of the named executive officers are based on the Committee’s assessment of the individual’s performance. Salary reviews are typically performed in the fourth quarter of the year for which the executive’s performance is evaluated, and corresponding salary adjustments are made during the same quarter of the fiscal year. The chart below shows salary adjustments in connection with performance reviews completed in fiscal year 2020.

In light of the performance of the Bank in fiscal year 2020, and the NEO’s contributions to the Bank’s strategy, including completion and negotiation of acquisitions during the fiscal year, the Committee recommended to the Board and the Board approved, the following base salary adjustments:

| 2019 Base Salary | 2020 Base Salary | % Increase | ||||||||||

| M. Ray (Hoppy) Cole, Jr. | $ | 490,640 | $ | 520,078 | 6 | % | ||||||

| Donna T. (Dee Dee) Lowery | $ | 281,040 | $ | 295,000 | 5 | % | ||||||

Performance-Based Cash Incentive Compensation

The Company has established an incentive bonus compensation plan that is based upon individual performance as well as Company performance. Cash incentives on an annual basis during the year following the year in which the services were performed and are contingent upon such executive officer's continued employment with the Company through the date of payment.

During the first quarter of 2020, independent directors of the Board, upon the recommendation of the Compensation Committee, established short-term cash incentive awards for executive officers as percentages of their 2020 base salary, as reflected in the table below (as a percentage of base salary).

| Threshold | Target | Maximum | ||||||||||

| M. Ray (Hoppy) Cole, Jr. | 15 | % | 30 | % | 60 | % | ||||||

| Donna T. (Dee Dee) Lowery | 7.5 | % | 15 | % | 30 | % | ||||||

Fiscal year 2020 performance goals for the NEOs for the cash-based incentive plan included Bank pre-tax net income, loan growth, and deposit growth. The metrics chosen represent company growth in earnings, assets, and deposits.

In addition to financial performance measures described above, each named executive officer was evaluated based upon unique individual performance goals in up to seven categories. The incentive plan provides each eligible officer with a “balanced scorecard” that establishes specific corporate and shareholder-related performance goals balanced by the officer’s area of responsibility, his or her business unit, and his or her expected individual level of contribution to the Company’s achievement of its corporate goals The particular individual performance measures were designed to reward the actions determined to be most important for that individual to achieve for the specified year. A rating of 1 through 4 was assigned for each NEO commensurate with performance. For fiscal year 2020, performance for each of the NEOs was measured in the following areas:

| · | Leadership; | |

| · | Strategic Planning; | |

| · | Financial Results; | |

| · | Succession Planning; | |

| · | Human Resources; | |

| · | Internal Communications; | |

| · | External Relations; and | |

| · | Board/CEO Communication. |

The range of specific targets and relative weights for each performance metric were as follows:

| Threshold 25% of Incentive | Target 50% of Incentive | Maximum 100% of Incentive | Actual | Payout % Earned | ||||||||||||||||

| Bank Pre-Tax Pre-Provision Income | $ | 78,162,557 | $ | 86,847,285 | $ | 91,189,649 | $ | 92,537,897 | 100 | % | ||||||||||

| Bank Total Loan Growth | 3,165,603 | 3,171,654 | 3,186,782 | 2,969,015 | 0 | % | ||||||||||||||

| Bank Total Deposit Growth | 3,683,598 | 3,693,737 | 3,719,084 | 4,282,351 | 100 | % | ||||||||||||||

| Individual Scorecard | 3 | 3 | 4 | 4 | 100 | % | ||||||||||||||

Based on the achievement of the performance metrics described above, the following cash incentives were awarded for the year ended December 31, 2020:

M. Ray (Hoppy) Cole, Jr.:

| Potential Payout as a % of Salary | Payout % Earned | Payout as a % of Salary | Actual Incentive Earned | |||||||||||||

| Bank Pre-Tax Pre-Provision Income | 20 | % | 100 | % | 20 | % | $ | 104,016 | ||||||||

| Bank Loan Growth | 10 | % | 0 | % | 0 | % | $ | 0 | ||||||||

| Bank Deposit Growth | 10 | % | 100 | % | 10 | % | $ | 52,007 | ||||||||

| Individual Scorecard | 20 | % | 100 | % | 20 | % | $ | 104,016 | ||||||||

| Total | 60 | % | 50 | % | $ | 260,039 | ||||||||||

Donna T. (Dee Dee) Lowery:

| Potential Payout as a % of Salary | Payout % Earned | Payout as a % of Salary | Actual Incentive Earned | |||||||||||||

| Bank Pre-Tax Pre Provision Income | 10 | % | 100 | % | 10 | % | $ | 29,500 | ||||||||

| Bank Loan Growth | 5 | % | 0 | % | 0 | % | $ | 0 | ||||||||

| Bank Deposit Growth | 5 | % | 100 | % | 5 | % | $ | 14,750 | ||||||||

| Individual Scorecard | 10 | % | 100 | % | 10 | % | $ | 29,500 | ||||||||

| Total | 30 | % | 25 | % | $ | 73,750 | ||||||||||

Discretional Bonus Payments

No discretionary bonuses were paid to our NEOs in 2020.

Equity Incentive Compensation

The Company makes awards of restricted stock to the NEOs pursuant to the terms and conditions of The First Bancshares, Inc. 2007 Stock Incentive Plan, as amended (the “2007 Plan”), generally based on the achievement of identified performance metrics. The Committee utilizes restricted stock as a long-term retention vehicle for key officers. In 2020, the Board, upon the recommendation of the Compensation Committee, established target performance-based long-term equity incentive awards for executive officers using shares of restricted stock with maximum earning opportunities of up to 6,500 shares for Mr. Cole and up to 3,300 shares for Ms. Lowery. Similar to the cash-based annual incentive plan, a pay-for-performance approach is used to determine the number of shares of restricted stock granted to each plan participant. In February of 2020, the Board established performance goals to be achieved over a one-year performance period ending December 31, 2020. The actual number of shares of restricted stock granted was determined based on the achievement of the performance goals. The performance goals utilized in the long-term plan design are linked to both corporate and shareholder performance criteria. For 2020, the performance goals included bank pre-tax net income, asset growth and credit quality as determined by a bank-wide credit administration score, as described in more detail below. The number of shares of restricted stock earned and issued pursuant to the award is determined based on the Bank’s achievement of the performance goals, and once granted the award is subject to cliff vesting on the fifth anniversary of the vest date. The metrics chosen represent company growth in both income and assets while maintaining asset quality.

The range of specific targets and relative weights for each performance metric were as follows:

| Threshold – 25% of Shares Earned | Target – 50% of Shares Earned | Maximum – 100% of Shares Earned | Actual | |||||||||||||

| Bank Pre-Tax Pre-Provision Income – 33% of Award | $ | 78,162,557 | $ | 86,847,285 | $ | 91,189,649 | $ | 92,537,897 | ||||||||

| Total Bank Assets – 33% of Award | 4,092,983,922 | 4,547,759,913 | 4,775,147,909 | 4,986,648,994 | ||||||||||||

| Bank-wide Credit Administration Score – 34% of Award | 3 | 2 | 1 | 1 | ||||||||||||

Results falling between the specified values reflected above result in proportional adjustment of the payout amounts.

Achievement of the performance measures set forth above for the year ended December 31, 2020 resulted in the following number of shares granted as restricted stock awards in March of 2021:

| Total Number of Shares at Maximum | Bank Pre-Tax Pre-Provision Income – 33% of Award | Total Assets – 33% of Award | Bank-wide Credit Administration Score – 34% of Award | Total Shares of Restricted Stock Awarded | ||||||||||||||||

| M. Ray (Hoppy) Cole, Jr. | 6,500 | 2,145 | 2,145 | 2,210 | 6,500 | |||||||||||||||

| Donna T. (Dee Dee) Lowery | 3,300 | 1,089 | 1,089 | 1,122 | 3,300 | |||||||||||||||

Special Equity Grants

On July 17, 2020, the Board of Directors awarded a special grant of restricted stock in the amount of 4,900 shares for Mr. Cole and 732 shares for Ms. Lowery for the successful completion and integration of the acquisition of First Florida Bank and Southwest Georgia Bank. The grants will cliff vest after five years from the grant date, subject to the executive’s continued employment on the vesting date.

Vesting and Retention Provisions Applicable to Equity Awards

The Company has implemented a policy that all shares granted through the 2007 Plan will include at least a three-year vesting schedule, unless extraordinary circumstances are determined by the Board. Beginning in 2014, the restricted stock awards earned based on the satisfaction of performance metrics will cliff vest on the fifth anniversary of the grant date, assuming the continued service of each of the holders through such vesting date. Vesting of such Awards will be accelerated in the event of the holder's death while in the service of the Company or upon such other event as determined by the Committee in its sole discretion. The 2007 Plan also contains a double trigger change-in-control provision pursuant to which unvested shares of stock granted through the plan will be accelerated upon a change in control if the executive is terminated without cause as a result of the transaction (as long as the shares granted remain part of the Company or are transferred into the shares of the new company). In October 12, 2016,2019, the Committee approved a modification to Mr. Cole’s and Ms. Lowery’s outstanding shares of restricted stock to provide that such shares will become fully-vested if (i) the Bank terminates his or her employment without cause; or (ii) he or she resigns for good reason within 24-months following a change in control, in the event that the outstanding restricted stock awards are not assumed by the acquiror in connection with such change in control. Unvested shares of restricted stock are subject to clawback and forfeiture provisions and may not be sold, pledged, or otherwise transferred or hedged during the vesting period.

Stock Ownership Guidelines